Table of Contents

Introduction

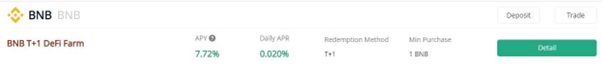

Staking BNB – The Hotbit exchange has over 350 investment programs for placing crypto. In addition to the usual “staking”, “farming” and “pool”, the terms “deposit” and “product” are used here. Without going into subtleties, we will consider these concepts synonymous: on certain conditions, we invest funds and receive rewards. So far, the site has only one investment program for Binance Coin (BNB):

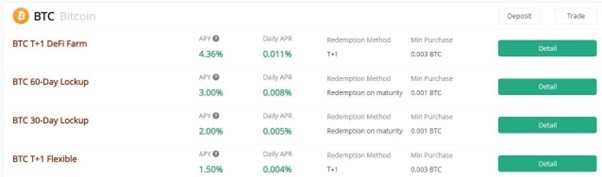

In turn, BTC offers 4 products to users. On the example of BTC let’s consider 4 popular programs.

BTC T+1 Flexible is a deposit with a flexible lock-up period and variable interest income. The minimum deposit is 0.003 BTC.

BTC 60-Day Lockup and BTC 30-Day Lockup are deposits with a fixed lock-up period and fixed income interest. Minimum deposit 0.001 BTC.

BTC T+1 DeFi Farm – a program with a flexible lock-up period, in which the exchange invests the raised funds in DeFi projects. The minimum deposit is 0.003 BTC.

Let’s take a closer look at each of these products.

Staking BNB – Fixed deposit

You have to choose between BTC 30-Day Lockup and BTC 60-Day Lockup – the interest is about the same, but the lock-up period is much shorter.

So far, details are available for each product. The product card reflects the main parameters including APY size and its change schedule, the level of risk according to the exchange assessment, the line showing how in time the lock-up and accrual of rewards occurs, the “Purchase now” button for depositing funds.The product is also described: where the income comes from, method of APY calculation, possible risks and rules of participation.

Deposit/withdrawal of funds is free, with no fees. Transferring from “Investment account” to “Trading account” is also free and is done in a couple of clicks. Trading and Investment accounts are internal accounts in an exchange account, similar to Binance’s “Main Account” and “Earn”.

What happens if at the time of changing the interest of income, there are funds on the deposit which entered there at the old rate – will the accrual be carried out at the old rate or reduced? Following the example of staking on Binance – the exchange allows itself to change the interest in the smaller side of the fixed rate and reduces the amount of daily accruals on current deposits. On the HotBit exchange everything happens similarly.

Staking BNB – Flexi deposit

This is a deposit with a flexible lock-up period and variable interest income.

Interest begins to accrue on the first day. “Redemption method T+1” means that in order to withdraw the funds and the accrued interest, you must manually make a request – press the “Redeem” button. Funds will go to the investment account the day after the request. Deposit/withdrawal of funds is free, without payment of commissions.

Not an interesting product at all, because often the rate of income decreases to the lower side, as a result you will not get a decent return on your funds.

Staking BNB and DeFi Farm BNB

This investment product is also available for BNB and has a stated APY almost twice higher than the similar BTC product. The indicator changes in real time. The description of the product says that the funds raised through this program, the exchange invests in DeFi-projects and that you should consider the risk associated with the security of smart contracts in which the exchange invests.

In the context of rewards accrual, Redemption method T+1 means that no interest is accrued for the first two days of “buying” the product, and the funds are already locked up. Thereby, the “net present” APY for the entire deposit period will be slightly less than stated. In the case of a short lock-up period, the decrease is noticeable, with a deposit of several weeks or more, a couple of days will be almost unnoticeable.

In conclusion

Flexi deposit with its low-income interest is not interesting. And fixed deposits and DeFi Farm are quite competitive and attractive in terms of ease of action and size of income.

During a month of testing, we noticed that the stated APY for the product BNB DeFi Farm ranges from 5% to 10% per annum. In addition to BNB, the exchange has products with interesting income interest for other cryptocurrencies as well. This makes Hotbit exchange a relevant platform for investment.

Related posts

Recent Posts

Healthcare Diagnostics: Advancing Patient Care with Annotated Medical Imaging

The landscape of healthcare diagnostics has been profoundly transformed by the integration of digital technologies, particularly through the use of…

2022 Tech Predictions: What’s About to Change?

2022 Tech Predictions As we approach a new year, how can we take what we’ve earned in 2020 and 2021…

![Staking BNB – DeFi Farm: Investment on Hotbit [2024]](https://www.computertechreviews.com/wp-content/uploads/2022/06/Staking-BNB-DeFi-Farm.-Investment-products-on-Hotbit.jpg)