AI Predictions Enhancing Crypto Trading

Price movement across crypto markets now reacts to patterns faster than human review can manage. Trading decisions gain strength when prediction systems study volume, order flow timing signals together. These systems process live data streams and then refine forecasts using continuous feedback. The key takeaway appears early. Smarter prediction models reduce reaction delay while improving trade timing consistency. When multiple exchanges show slight price gaps, predictive logic helps traders act with confidence rather than guesswork. Accuracy improves not through chance but through structured learning methods that adapt with every market shift.

Table of Contents

Predictive Market Signals

AI-driven prediction systems observe trading signals across exchanges to detect repeatable movement behavior. By comparing liquidity shifts, spread change, and order pressure patterns, they identify moments when value differences appear. These insights support timely execution without emotional bias. Platforms such as Zyra Capital apply predictive models to align data streams from various exchanges, which allows trades to follow probability rather than impulse. The result is a clearer decision structure with reduced response lag during volatile periods.

Cross Exchange Analysis

- Price gaps emerge when buying pressure rises unevenly across connected trading platforms

- Volume changes reveal hidden demand strength before visible price movement occurs

- Order flow direction helps predict short-term momentum across paired assets

- Timing signals reduce late entries that often follow emotional reactions

Learning Model Accuracy

Prediction strength depends on how learning systems adjust after each completed trade. Models refine internal logic by comparing expected outcomes with actual results. Over time, accuracy improves as noise signals lose influence. This adaptive process allows forecasts to stay relevant even when market behavior shifts. Instead of relying on static rules, learning based systems evolve with every data cycle, creating a stable foundation for repeated decision quality.

Risk Control Methods

- Predictive alerts help traders avoid overexposure during unstable price swings

- Data-driven thresholds limit losses before emotional decisions appear

- Pattern recognition supports exit timing when momentum weakens

- Historical comparison reduces reliance on instinct-based reactions

Liquidity Timing Benefits

Trading across multiple exchanges requires precise timing due to varying liquidity levels. AI predictions identify moments when depth increases enough to support larger orders without slippage. This insight protects value while executing strategies at scale. Liquidity awareness also helps avoid thin periods that distort pricing. By acting during optimal windows, traders maintain efficiency while reducing unnecessary costs caused by rushed execution.

Automated Strategy Scaling

As prediction accuracy grows, strategies can scale without manual monitoring. Automated execution follows predefined probability conditions rather than constant supervision. This structure supports consistency across repeated trades. AI systems manage complexity by handling multiple signals at once while maintaining discipline. The approach reduces fatigue-related errors while allowing traders to focus on oversight rather than constant reaction.

Portfolio Balance Logic

- Allocation adjustments follow probability scores instead of emotional preference

- Asset weight shifts respond to forecast strength across connected markets

- Exposure control protects capital during uncertain movement phases

- Consistent balance rules support steady long-term performance

Insight Driven Decisions

Prediction systems convert complex data into clear signals that guide action. Rather than reacting to surface price changes, traders rely on deeper pattern awareness. This method builds confidence through logic rather than speculation. Over time, decision quality improves as trust forms in structured insight. The use of predictive intelligence creates a stable trading rhythm where actions follow analysis rather than urgency.

Smarter Trading Path

Predictive intelligence reshapes how crypto trading operates across multiple exchanges. By blending pattern learning, risk control, and timing awareness, traders gain clarity in uncertain markets. The strength lies in preparation rather than reaction. When systems adapt continuously, they reduce guesswork while supporting disciplined execution. Firms such as Zyra Capital reflect this approach by aligning prediction insight with structured strategy. The future of trading favors those who trust informed signals guided by learning models that grow sharper with every cycle.

FAQs

How do AI predictions improve trade timing?

They analyze live data patterns to identify optimal entry and exit moments.

Do predictive systems remove trading risk?

Risk remains yet structured signals help manage exposure more effectively.

Can beginners use AI-based trading tools?

Yes, since automated logic simplifies decision processes without great technical skill.

Why multiple exchanges matter for predictions

Comparing platforms reveals price gaps that single exchange views miss.

How often do models update predictions?

They adjust continuously as new data enters the system.

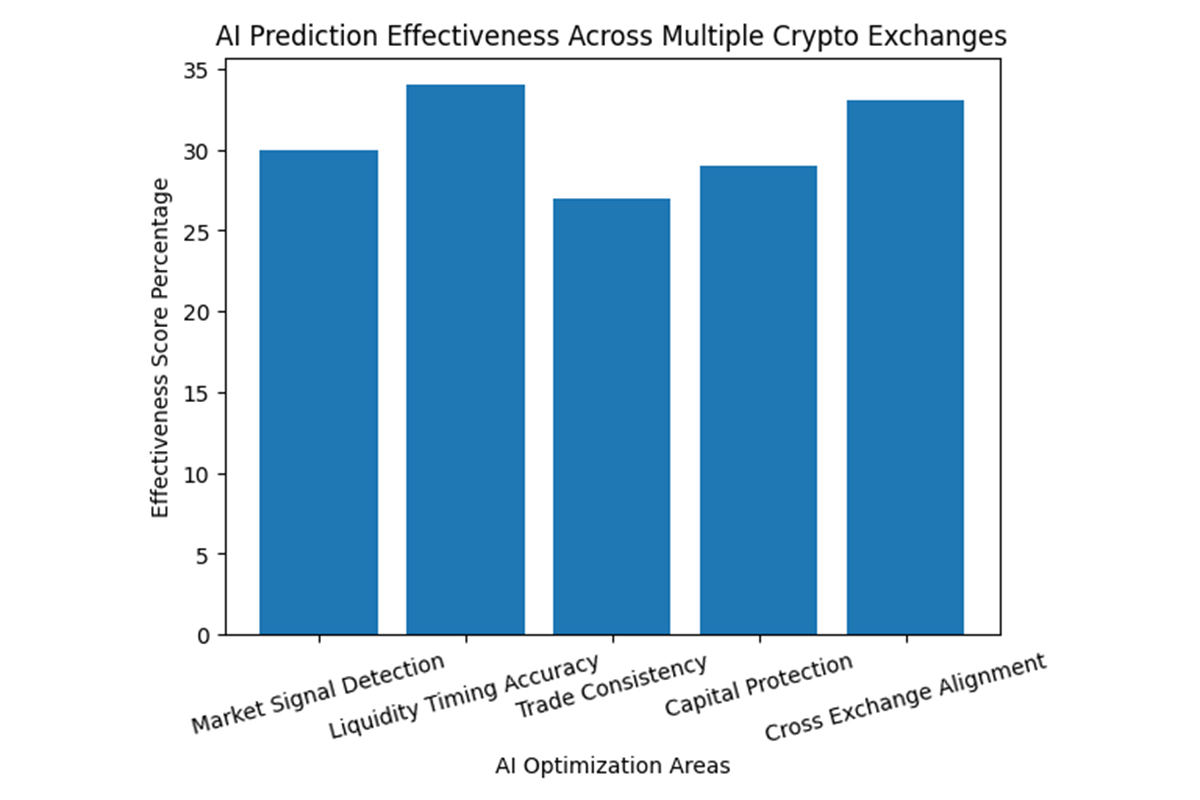

Bar Chart Context Explanation

This bar chart represents effectiveness score percentages across broader AI optimization areas used in multi-exchange crypto trading. Liquidity, timing accuracy, and cross-exchange alignment show the strongest influence, indicating that predictive systems perform best when synchronizing price signals and depth conditions. Market signal detection and capital protection maintain steady contribution while trade consistency reflects gradual improvement through repeated model learning. The chart supports research observations that AI predictions deliver balanced performance gains rather than isolated advantages, reinforcing structured decision-making across connected exchanges.