Using vatlayer to calculate VAT taxes on your website

Let’s face it, taxes are difficult, and if your customer base is in the EU, you could face legal consequences if you get it wrong.

Luckily there’s an easy-to-use API called vatlayer that can handle this for you. vatlayer is a simple JSON-based REST API that saves you time by helping you get the right rates based on your product. vatlayer also saves your company money by offloading the developer time needed to implement the complicated EU tax schemes for EU companies.

Finally, vatlayer helps you geofence your products by applying the right taxes to the right customers by using their IP.

Ready to find out how you can use vatlayer to calculate VAT taxes? Let’s get started.

Table of Contents

How to use vatlayer to calculate VAT taxes?

Calculating VAT taxes with vatlayer is super quick and easy. You request results using a transparent URL structure, and the API delivers the result in an easy-to-understand and lightweight JSON format.

This makes it compatible with any of your systems, programming languages, applications, and frameworks.

The steps below show an example of how to calculate VAT taxes using vatlayer.

Step 1

First, you need to head to Start using the API vatlayer and sign up to get your free personal API access key. You receive a unique password that lets you access any of the API’s data endpoints. You can use this key for either demo or personal projects.

Step 2

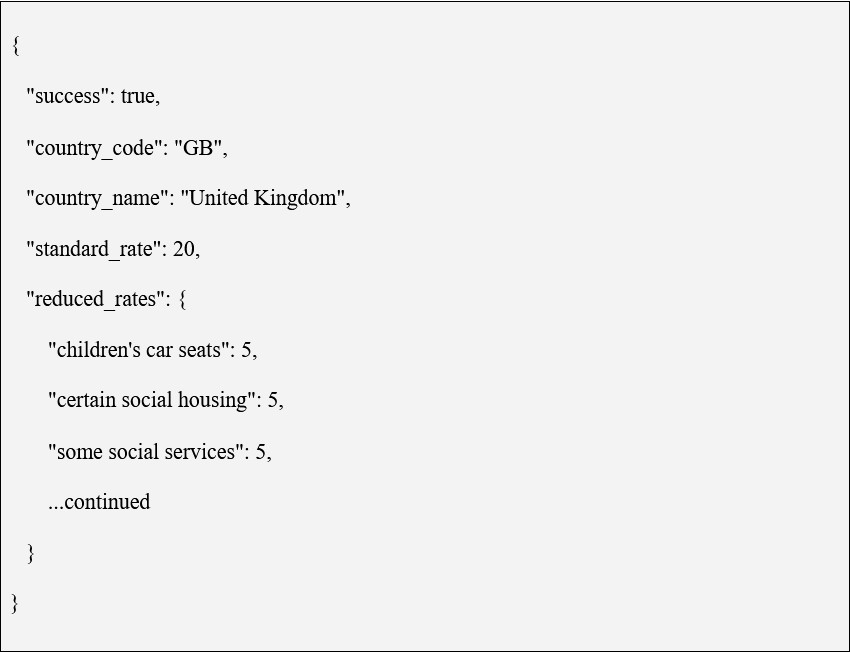

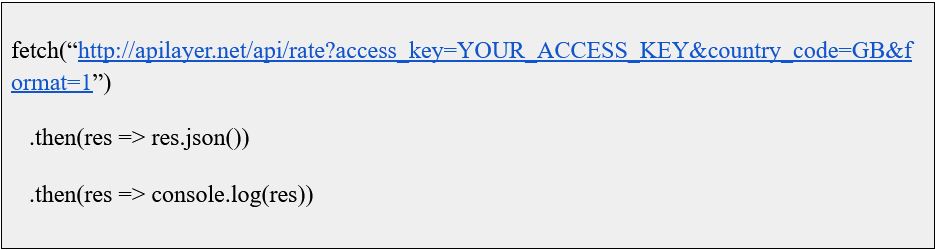

Let’s say you want to send a GET fetch request to get the rate for GB in JavaScript. You can use the following code to do so:

The code above gives you the following result in your console:

What else can VAT Layer help you do?

The vatlayer API has a ton of endpoints that you can use in your applications – it enables you to validate VAT numbers, convert prices so that they are in compliance with EU VAT rates and types, and get all or single EU VAT rates based on country code or IP address.

VAT price calculation and Advanced VAT Price calculation

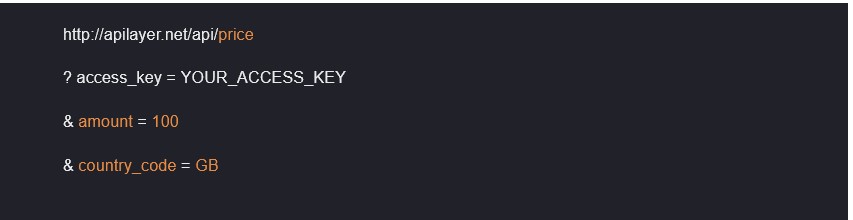

You can use the price endpoint to calculate VAT compliant prices by simply specifying the amount that you want to use for your VAT price calculation and the country code.

For example, you can use the code below to calculate VAT compliant prices using the price endpoint:

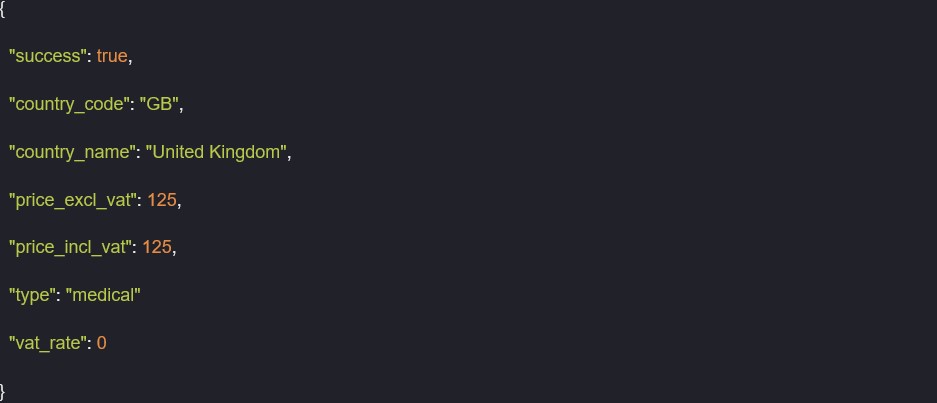

The code above yields the following results:

One of the coolest features of the API is advanced VAT price calculation using the Price endpoint. You can specify the type of goods. You can also request the API to perform a reverse calculation.

For example, you can use the code below for Advanced Vat Price calculation using the price endpoint:

The code above yields the following results:

VAT number validation

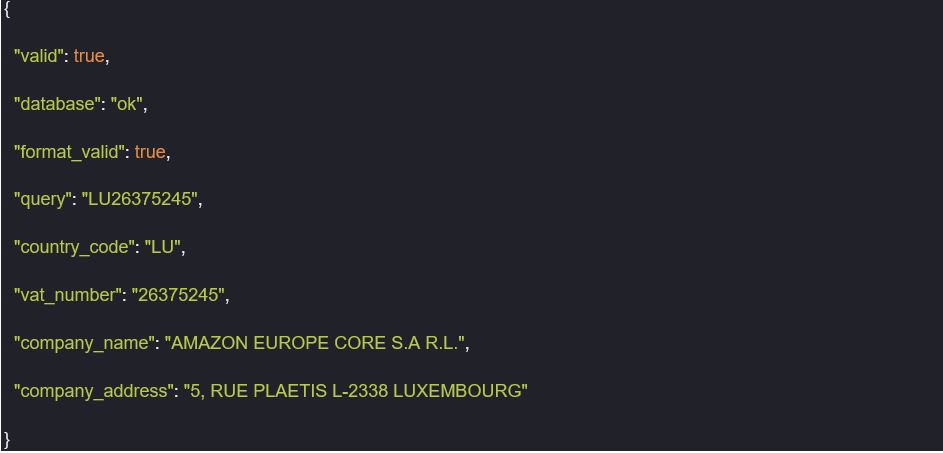

You can use the validate endpoint to perform VAT number validations and company information lookups simply by specifying the VAT number that you want to validate. One of the best things about this endpoint is that it is available for both free and paid users.

For example, the code below can be used to validate VAT number:

The code above yields the following results:

All EU member state VAT rates

As we explored, you can get the rates of specific countries, or you can request the API to return the VAT rates for all EU member states at once using the rate_list endpoint.

You can request the VAT rates of all EU member states using the code below:

VAT rates via a specific IP address or the Client’s IP

Besides getting VAT rates via a country code, you can also get rates via a custom IP Address or the Client’s IP using the rate endpoint.

For example, you can request VAT rate via a specific IP address using the code below:

And you can request VAT rate via the Client’s IP using the code below:

Which Additional Features make vatlayer Great?

Data accuracy

vatlayer collects data from reliable sources, such as the European Commission’s databases. You can trust it to provide the most accurate and up-to-date VAT rates and VAT number validation.

Data security

vatlayer is designed to provide secure and encrypted data streams. It lets you establish a secure connection through 256-bit HTTPS encryption, which is an industry-standard. However, this feature is only for paid users.

Cost-effective subscription plans

vatlayer offers various cost-effective subscription plans as well as a free plan. The free plan offers as many as 100 API requests and can be used for an unlimited time. If you want a higher request volume, you can choose from paid pricing plans starting from just USD 9.99/month.

Extensive Documentation

Not only does vatlayer come with detailed documentation, but once you’ve signed up, you can also try out the features of the API as you go through the documentation.

Ready to use vatlayer to calculate VAT rates?

Now that you know how to use vatlayer to calculate VAT rates, validate VAT numbers or perform advanced VAT price calculation, try vatlayer today and see how it helps you build a robust web application that applies the right VAT to the right customers.