Schedule C Instructions for Self-Employed to File Form 1040

Table of Contents

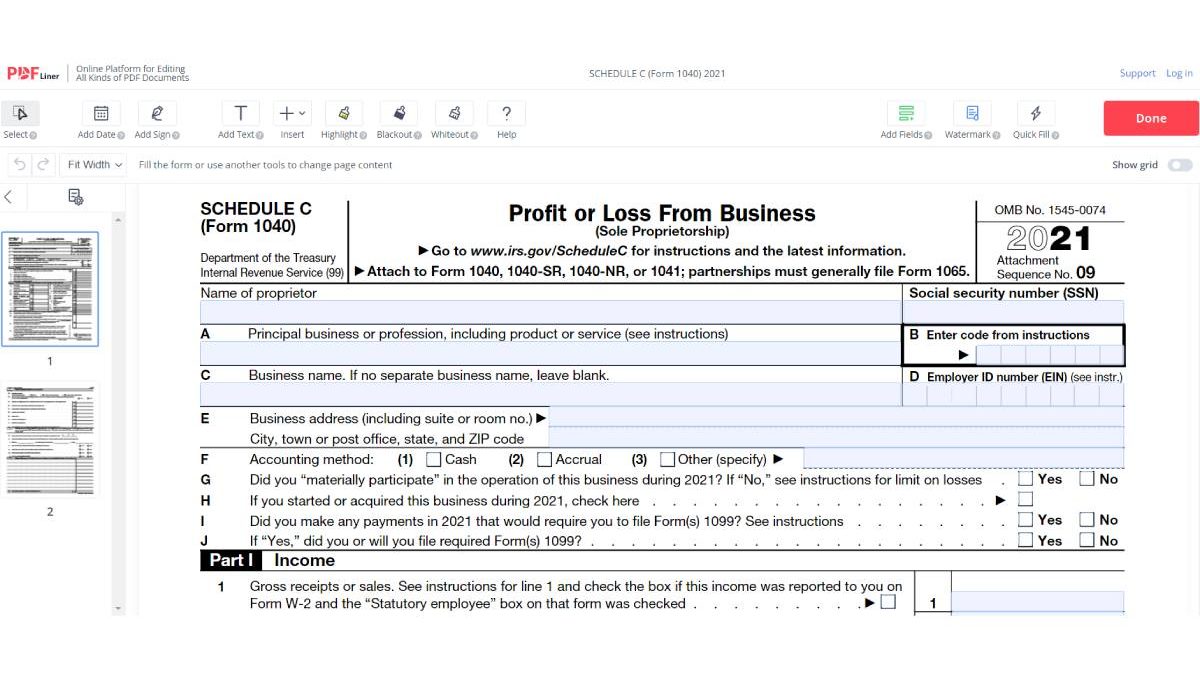

Schedule C Instructions to File Form 1040 in 2022

If you are self-employed, you might need to fill out the IRS Schedule C to report profit or loss from business or a job you performed as a sole proprietor. Here we provide you with simple guidance on Schedule C meaning, purpose, and some tips to help you save both time and money.

What Is Schedule C?

Fillable Schedule C 2022 is part of a 1040 tax form. Sole proprietors use it to report on the amount of money they made or lost in their business during the last year. If your initial purpose for undertaking the activity is for income or you perform this activity regularly, you might require Schedule C: Profit or Loss From Business (Sole Proprietorship) during the tax period. The IRS needs the data provided in Schedule C to calculate the taxable profit and estimate any taxes or compensations owed.

Who Files a Schedule C?

If you are a freelancer, set up your business as a sole proprietorship, or otherwise work for yourself, you should file Schedule C with a 1040 form to report the income or loss for your business. You don’t need to complete it to let the IRS know about the income from your hobby. If you have more than one business, you have to file a separate 1040 Schedule C form for each one.

You’re considered a sole proprietor in the following cases:

- you aren’t subject to a boss who withdraws a part of your salary for taxes;

- your business isn’t a partnership or a corporation;

- you are a single-member LLC that isn’t taxed as an S corporation.

How to Fill Out Schedule C?

Before we proceed to the Schedule C filling-out procedure, consider the data you’ll need:

- your business balance sheet and earnings report for the last year;

- receipts for your business expenditures;

- inventory documentation;

- vehicle records if you have one and use it for business purposes.

Now that you’ve prepared all the essential information, we will walk you through all five parts of Schedule C by providing distinct Schedule C instructions:

Step 1: In part I, you have to calculate your sales and report the cost of goods sold. This part reveals your gross profit.

Step 2: Report your business expenditures in part II. A bunch of categories is included to help you stay organized, such as car and truck expenses, advertising, legal and professional services, rent, meal, and travel expenditures, etc. You have to sum up all the expenses and deduce them from your gross profit to end up with your net profit (income taxable for your personal tax return). Your net loss can be estimated with your personal tax return. The IRS official site provides a distinct explanation for each type of expense if you are confused with the terminology.

Step 3: In part III, calculate the price of goods sold.

Step 4: If you used a car or a truck during the reported tax year, claim the vehicle-related expenses in part IV.

Step 5: In part V, specify other business expenditures that didn’t fit into the categories in part II.

Schedule C Tips and Tricks

Business tax forms, like the IRS Schedule C, can get tricky when you are left to complete them on your own. In this section, we would like to offer some supportive tips to ease the procedure for you:

- you might need to complete other tax forms outside of Schedule C, such as a Schedule SE tax form, Form 4562 to report on business loss, or Form 8829 for actual expenditures from business use of your home apartment;

- make calculated tax payments each quarter to avoid late-payment fines;

- take advantage of addressing reliable tax software providers to prepare Schedule C. It is more convenient to fill out the form online on a specialized platform, and it costs less than hiring a specialist to report on your taxes.

Taxes Reported in a Blink of an Eye

As you see, it’s quite easy to complete Schedule C by following detailed instructions. Try to avoid common mistakes while filling out this tax form, such as typos in names and SSNs, math errors, and missing the April 15th due date. Use specialized software to assist you during the filing session. If you have any questions you would like to clarify, you can drop a comment or two below.

Based on article by pdfliner.com

Author

Dmytro Serhiiev

Tax Consultant & Co-Owner at PDFLiner